The Only Guide to Fortitude Financial Group

All About Fortitude Financial Group

Table of ContentsSee This Report about Fortitude Financial GroupThe Only Guide to Fortitude Financial GroupThe Buzz on Fortitude Financial GroupNot known Facts About Fortitude Financial GroupA Biased View of Fortitude Financial Group

Keep in mind that several experts won't handle your properties unless you satisfy their minimum requirements (Financial Resources in St. Petersburg). This number can be as low as $25,000, or get to into the millions for the most unique experts. When selecting a monetary advisor, learn if the specific adheres to the fiduciary or suitability standard. As kept in mind earlier, the SEC holds all consultants registered with the agency to a fiduciary standard.If you're looking for monetary guidance yet can not pay for a monetary consultant, you might take into consideration utilizing a digital investment advisor called a robo-advisor. The broad field of robos spans systems with access to financial experts and investment management. Equip and Betterment are 2 such examples. If you're comfortable with an all-digital platform, Wealthfront is one more robo-advisor option.

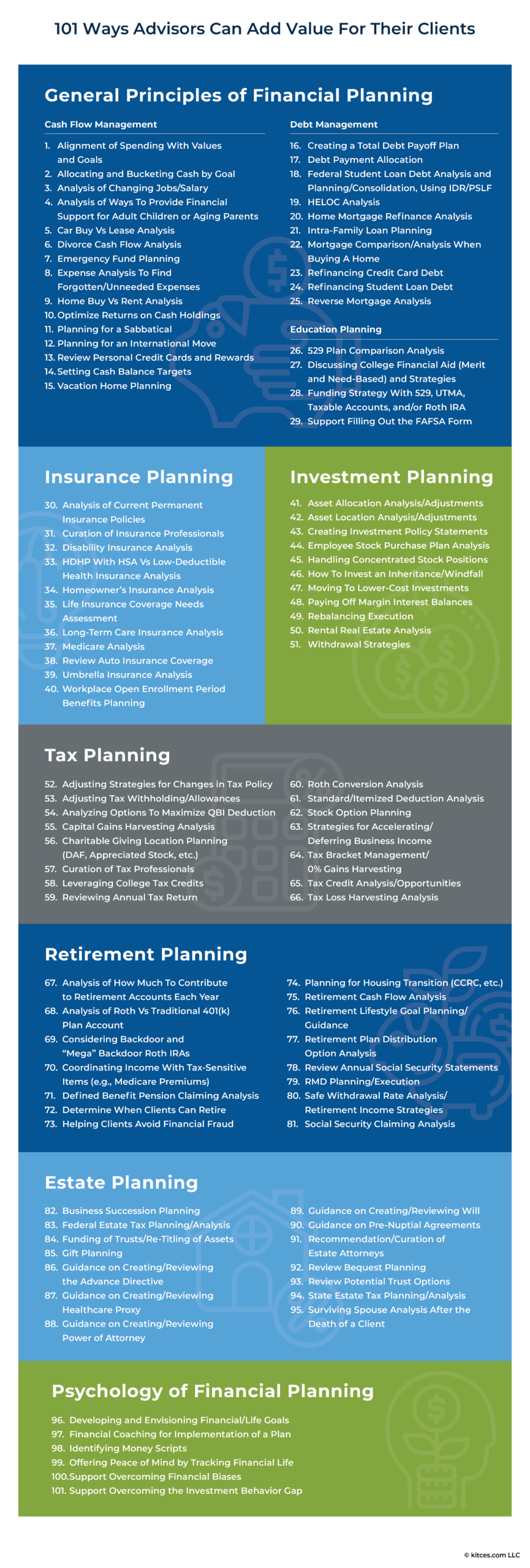

Financial advisors may run their own company or they might be part of a larger workplace or financial institution. No matter, an advisor can help you with every little thing from constructing a financial strategy to spending your money.

Fortitude Financial Group Fundamentals Explained

Think about collaborating with a economic expert as you create or modify your financial strategy. Discovering a monetary expert does not need to be hard. SmartAsset's complimentary device matches you with as much as three vetted monetary consultants who offer your location, and you can have a complimentary initial call with your expert matches to make a decision which one you really feel is appropriate for you. See to it you ask the ideal inquiries of anyone you think about working with as a financial expert. Inspect that their credentials and abilities match the services you desire out of your advisor - https://www.openstreetmap.org/user/fortitudefg1. Do you intend to discover more about financial consultants? Have a look at these articles: SmartAsset adheres to a rigorous and thorough Editorial Plan, that covers concepts bordering precision, reliability, editorial self-reliance, expertise and neutrality.

Lots of people have some psychological connection to their cash or the things they acquire with it. This psychological connection can be a primary reason we might make bad monetary decisions. A specialist monetary advisor takes the feeling out of the formula by offering objective advice based on understanding and training.

As you undergo life, there are economic choices you will make that may be made a lot more conveniently with the assistance of a professional. Whether you are trying to reduce your debt load or intend to begin intending for some long-lasting objectives, you can take advantage of the solutions of a monetary expert.

The Best Guide To Fortitude Financial Group

The fundamentals of financial investment administration include acquiring and offering economic possessions and other investments, however it is moreover. Managing your financial investments includes recognizing your brief- and long-term objectives and utilizing that info to make thoughtful investing choices. A monetary consultant can offer the information needed to aid you expand your financial investment portfolio to match your desired level of risk and fulfill your financial goals.

Budgeting offers you an overview to navigate to this website exactly how much cash you can invest and just how much you must save each month. Following a spending plan will certainly aid you reach your brief- and long-term financial objectives. A monetary advisor can help you detail the activity steps to require to establish up and keep a spending plan that helps you.

Occasionally a clinical bill or home repair can all of a sudden include in your financial obligation load. A professional financial obligation administration strategy helps you settle that debt in the most monetarily helpful means possible. An economic expert can aid you analyze your financial debt, focus on a financial debt repayment strategy, give options for debt restructuring, and outline an all natural strategy to far better take care of financial debt and satisfy your future economic objectives.

Getting The Fortitude Financial Group To Work

Individual cash money flow analysis can tell you when you can manage to get a brand-new automobile or just how much cash you can add to your savings monthly without running brief for required expenses (Investment Planners in St. Petersburg, Florida). A monetary expert can help you plainly see where you spend your cash and afterwards apply that understanding to assist you recognize your financial well-being and exactly how to improve it

Threat administration services identify prospective threats to your home, your automobile, and your household, and they aid you put the appropriate insurance coverage in position to mitigate those dangers. A financial expert can assist you establish a technique to safeguard your gaining power and decrease losses when unexpected things happen.

Getting The Fortitude Financial Group To Work

Reducing your tax obligations leaves more money to add to your investments. Investment Planners in St. Petersburg, Florida. A monetary consultant can assist you make use of charitable providing and investment techniques to lessen the quantity you have to pay in tax obligations, and they can reveal you just how to withdraw your money in retirement in a means that also decreases your tax burden

Also if you didn't start early, university planning can assist you place your kid with college without encountering all of a sudden large expenditures. A monetary expert can direct you in recognizing the best means to conserve for future university costs and exactly how to fund potential gaps, discuss exactly how to reduce out-of-pocket college costs, and recommend you on eligibility for financial help and gives.